Bond investors in Argentina’s utilities may turn out to be the biggest winners if opposition candidate Mauricio Macri wins Sunday’s presidential election runoff.

After years of near-frozen tariffs, Macri has said subsidies should be redistributed to benefit only the most needy. That would imply higher rates paid by a majority of Argentine homes and improve the financial situation of electricity distributors such as Cia de Transporte de Energia Electrica en Alta Tension and Empresa Distribuidora y Comercializadora Norte.

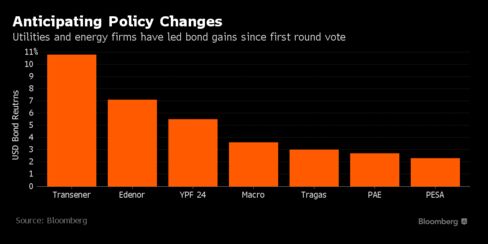

That expectation has already led to a rally in utility bonds since Oct. 25, when Macri, who has promised a more market-based economy, won enough votes in the first round to force a runoff against the ruling party’s Daniel Scioli. Transener’s 2021 notes have returned 10.8 percent in that span, while Edenor’s 2022 securities have jumped 7.1 percent.

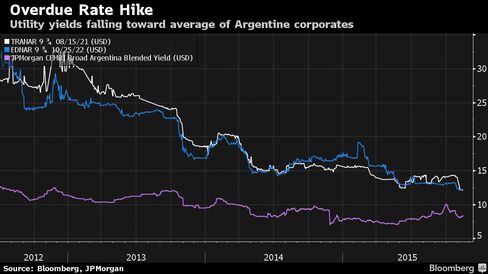

The resurgence for the utility companies, whose tariffs have been almost unchanged since Argentina’s economic crisis in 2002, has been spectacular. After trading as low as 35 cents in 2012, the electricity distributors have since returned about 300 percent as President Cristina Fernandez de Kirchner failed to secure a third term and Macri said the current subsidy structure is unsustainable. Argentina’s worst deficit in nearly 30 years also will increase pressure on the next government to change policies including electricity subsidies. Power bills in upper-middle class homes in Buenos Aires total just 40 pesos ($4.15) every two months.

More Gains

“These are companies with low debt levels and without maturities for at least another six years, which will give them time to improve fundamentals based on a new tariff structure,” said Juan Manuel Vazquez, an analyst at Puente in Buenos Aires. “With a Macri win, the bond prices could rise above par.”

The utilities have functioned in a zombie-like state for years, with Fernandez’s government propping them up just enough to continue providing services while directly controlling how they use funds for investment.Fernandez limited power companies losses by subsidizing electricity prices charged by wholesale electricity seller Cammesa SA, which is controlled by the state, and by forgiving debt and fines owed to the government. Scioli said during a debate Sunday that he would keep subsidies unchanged.

Macri had 46.5 percent support in a Nov. 9-12 Management Fit poll of 2,400 people, compared with 39.9 percent for Scioli. The survey, which had a margin of error of 2 percentage points, shows 11.1 percent of people are still undecided, with 2.1 percent planning to cast a blank vote.

Ratings Boost

Edenor, which supplies electricity to 3 million people in and around Buenos Aires, could be in line for an upgrade to its current Caa1 rating, which is seven levels below investment grade, if Macri wins and a tariff increase is granted, according to Daniela Cuan, an analyst at Moody’s Investors Service. A devaluation of the peso, however, may erode the company’s cash position and dent its ability to meet foreign-debt obligations, she said.

Macri has vowed to let the peso float on his first day in office, which means it could trade somewhere between the government-controlled official rate of about 9.6 pesos per dollar and the black-market rate of 15 pesos per dollar. Scioli says he would undertake gradual changes while leaving capital controls in place initially.

State-controlled energy company YPF SA has also posted outsized returns since the first- round vote. Its bonds due 2024 and 2025 have jumped more than 5.4 percent, compared with an average 4.1 percent gain for Argentine companies, according to the Bloomberg USD Emerging Market Corporate Bond Index.

The oil industry benefits from a system of domestic prices that are much higher than international levels, which has caused gasoline prices at the pump to jump in the past few years. The web of capital controls created by Fernandez’s administration since 2011 has made attracting investment to the industry difficult, leading to stagnant economic growth.

Argentine corporate bonds will track sovereign notes if investors favor a new, more market-friendly administration, according to former finance secretary Daniel Marx.

“Once Argentina’s risk drops, all these companies will receive a windfall,” said Marx, who was finance secretary from 1999-2001 and is now executive director of Buenos Aires-based research company Quantum Finanzas. “I see room for yield compression.”