Faith in President Mauricio Macri has rewarded holders of Argentina’s utility bonds.

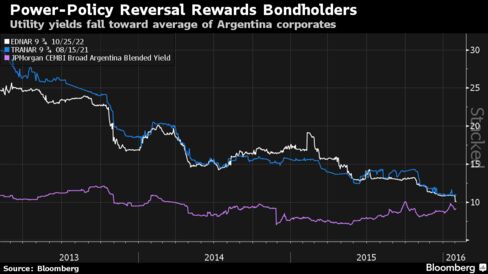

Benchmark notes from the country’s two biggest power providers, known as Edenor and Transener, have surged at least 18 percent since Macri’s surprisingly strong showing in the first round of presidential elections on Oct. 23, compared with losses of 1.5 percent for emerging-market peers. Investors piled into the bonds on wagers that Macri would end a cap on electricity rates that allowed the companies just enough revenue to continue providing services.

Last week, that speculation was proved right when Macri raised tariffs on energy. That’s going to bring utility companies to a “state of normalization,” according to Moody’s Investors Service, which upgraded the credit rating of Empresa Distribuidora y Comercializadora Norte SA by one step Monday. Moody’s doesn’t have a rating for Cia. de Transporte de Energia Electrica en Alta Tension Transener SA.

“The policies help seal that positive sentiment people had,” said Jason Trujillo, a senior emerging-markets analyst in Atlanta at Invesco Ltd., which has $776 billion under management. “We expect that the benefits will be seen in the first quarter, like higher profitability, which will be reflected in better balance sheet metrics. Among the various corporate opportunities within Argentina, the utility sector with these tariff increases is looking more attractive.”