Argentina will move forward with plans to lift currency controls and let the peso float as President Mauricio Macri tries to fulfill campaign promises to create a more open economy.

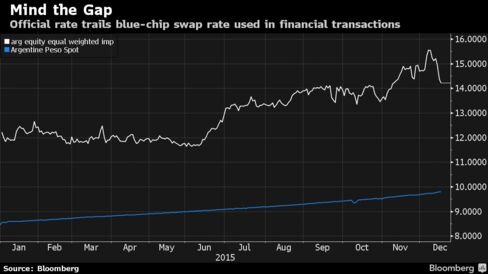

The move will imply a devaluation of the official exchange rate which has been tightly controlled by the central bank under a crawling peg system. The official rate of 9.82 pesos per dollar compares with a black market rate of 14.5 pesos. Finance Minister Alfonso Prat-Gay will make the announcement at a press conference at 6 p.m. in Buenos Aires on Wednesday, according to the ministry.

The unwinding of currency controls is one of the largest hurdles Macri’s government faces as it tries to move to a single exchange rate to improve the competitiveness of the economy and attract investment while at the same time trying to rebuild reserves needed to control the magnitude of a devaluation. Macri has lifted farm export taxes on most products in the hopes of getting farmers to empty silo bags full of crops to bring money into the central bank. At the same time, a group of international banks are working to lend Argentina money in exchange for a one-year note backed by foreign currency debt held by the central bank, according to people involved in the talks.

“It’s not a process devoid of risk but there’s also significant risk in doing this in several installments,” Alberto Ramos, chief Latin America economist at Goldman Sachs Group Inc. said by telephone from New York. “The economy is weak and therefore its a more risky proposition than in other places but it’s unavoidable. If they felt that the risk is too high they would have waited to get the pieces in place to be a little more sure.”

A devaluation of the exchange rate also risks accelerating inflation already running at 24 percent annually and sparking social discontent. The economy is stagnant and Macri needs to promote foreign investment to prop up reserves that have tumbled to a nine-year low of $24.3 billion.

The central bank on Tuesday raised yields on its shortest-maturity notes to as high as 38 percent in the first weekly auction overseen by Federico Sturzenegger in a bid to stoke demand for peso assets and limit the slide in reserves ahead of the expected devaluation.