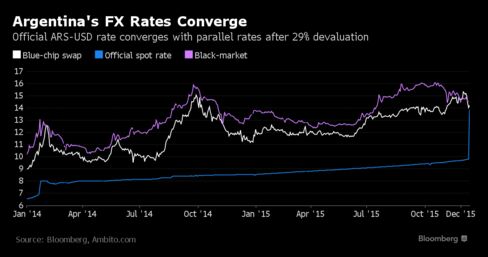

Argentina’s onshore peso futures tumbled as local trading resumed a day after president Mauricio Macri fulfilled his pledge to devalue the currency and let it float freely.

Three-month onshore forwards dropped to 13.71 pesos per dollar as of 12:57 p.m. in Buenos Aires, down 23 percent since they last traded Nov. 20. Local trading had been suspended for nearly a month as a growing gap between prices in onshore and offshore markets spurred criticism that the central bank was propping up the domestic market to stem expectations for a devaluation ahead of elections the governing party lost.

The drop in onshore contracts Friday brought prices closer to the 14.35 per dollar level for foreign futures. Allies of Macri had said the central bank, by selling the futures at artificially low prices, was setting itself up for a massive loss once the inevitable devaluation occurred, leading to a judicial probe into the sales. Trading volume on the local Rofex exchange more than doubled from a year earlier in October as investors sought to profit from the gap between prices in onshore and offshore markets.

"Now, the Rofex doesn’t have the pressure that the central bank was exerting to keep the peso rate low," said Rafael Di Giorno, a director at Proficio Investment in Buenos Aires. "The Rofex is probably going to be a better indicator of the market going forward than it was before."

In a regulatory filing late Monday, the futures exchange said it would rewrite foreign-exchange contracts opened since Sept. 29 to add between 1.25 and 1.75 pesos per dollar as part of a package of emergency measures to prepare for the devaluation and limit its losses.

Argentina’s official peso rate gained 0.1 percent to 13.39 per dollar on the MAE electronic platform in Buenos Aires, after tumbling 27 percent Thursday. Late Thursday, Argentina’s finance minister declared the first day of a free-floating peso a success, saying its decline was in line with his expectations and showed there’s no outsize demand for dollars in the country.

Prat-Gay said $45 million was traded in the official currency market Thursday, of which $20 million were grain exporters selling greenbacks to buy crops. The central bank didn’t intervene in the currency market, the monetary authority said in an e-mailed statement. Reserves fell $14 million to $24.1 billion, the smallest decline since Macri took office about a week ago.

The central bank on Tuesday raised yields on its shortest-maturity notes to as high as 38 percent in the first weekly auction overseen by bank President Federico Sturzenegger in a bid to stoke demand for peso assets. A benchmark deposit rate known as Badlar rose to 27.4 percent on Wednesday, the highest since October 2002.

The free float carries risks, with a weaker currency potentially exacerbating inflation already estimated to be running at 25 percent and spurring a backlash from Argentines who see the value of their savings sink in dollar terms.

Morgan Stanley estimates that a quick devaluation of the peso may lead inflation to accelerate by about 10 percentage points to 35 percent in 2016. Economic growth, which has been largely stagnant the past four years, is forecast at 0.6 percent in 2016 and 3.6 percent the following year, according to the median estimate of 20 economists surveyed by Bloomberg.

Until Thursday, Argentines had to seek tax-agency approval to buy a limited amount of dollars for travel or savings. If those options failed, individuals turned to a black market where the peso traded much weaker than the official rate. The tracking of the black market rate had become an obsession in the country with its value displayed prominently on television news programs and on front pages of the country’s main newspapers.