Argentina, the world’s third largest grower of soybeans, lifted four years of currency controls Wednesday after grains exporters agreed to deliver $6 billion in hoarded crops to the country over the next three weeks.

The country will let the peso float starting tomorrow, prompting a devaluation of the tightly controlled official exchange rate, Finance Minister Alfonso Prat-Gay told reporters at a press conference in Buenos Aires on Wednesday.

"We have reached an agreement with grain exporters that starting tomorrow will bring in $400 million a day over three weeks," Prat-Gay said. "Through many other channels we expect to have a total inflow of between $15 billion to $25 billion in the next four weeks.”

Argentine farmers have been storing crops, partly in protest of the taxes and the difficult process of obtaining export permits. Farmers have $11.4 billion of soy, corn and wheat for sale, Ricardo Echegaray, former head of Argentina’s tax agency, said Dec. 1. They have about $6 billion worth of soybeans available for exports, $3.4 billion worth of corn and $2 billion worth of wheat, he said.

Argentina’s new President Mauricio Macri on Monday announced the elimination of export taxes on crops, including corn and wheat, carrying through on a campaign pledge. The soybean tariff was cut by 5 percentage points.

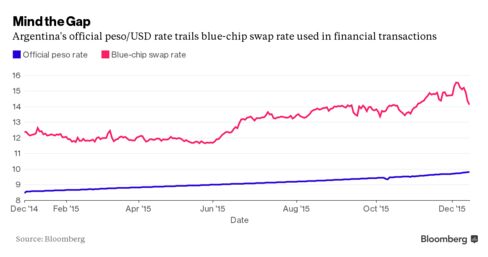

The policy change will unleash crops hoarded by farmers and lead to a large increase in shipments, according to grain and oilseed exporter group Ciara-Cec. Argentine farmers sold $437 million for exports in the last month, the group had said. The official peso traded at 9.8 pesos per dollar on Wednesday, while the blue-chip swap market was 14.02 pesos per dollar, Prat-Gay said.

“The lifting of the FX control policy was the last measure needed to motivate crop sales for export,” Andres Alcaraz, a Ciara-Cec spokesman, said in a telephone interview from Buenos Aires. Combined with the reductions to export taxes and eliminated export permits, the move “confirms the battery of measures that will provoke huge sales.”

Grain prices fell on Wednesday on the Chicago Board of Trade before the announcement.

Corn futures for March delivery dropped 2 percent to close at $3.6975 a bushel in Chicago. Prices touched $3.6925, the lowest for a most-active contract since Dec. 3. Soybean futures for delivery in the same month fell 0.5 percent to $8.6325 a bushel, while wheat futures tumbled 2.2 percent to $4.8350, the biggest drop in a month.

The slide in grain prices comes amid a commodity slump, with the Bloomberg index of raw materials falling for a fifth session to the lowest since 1999. In the U.S., the Federal Reserve raised interest rates on Wednesday, in the first increase in seven years.

Peso Movement

The country, which is the leading world exporter of soybean derivatives, has shipped $17.9 billion of grains and oilseeds abroad this year to date, the lowest for the period since 2009, according to data compiled by exporters.

“They cut the tariffs, but I think most of the producers were waiting on the peso move before they made any sales,” Alan Brugler, president of Brugler Marketing and Management in Omaha, Nebraska, said in a telephone interview. “There’s still the question of how low they’re going to go.”

In the current marketing year, Argentina is forecast to be the world’s fourth-largest corn exporter and third-largest soybean exporter, according to a Dec. 9 report from the U.S. Department of Agriculture. The agency increased its estimate for Argentina’s wheat exports by 20 percent to 6 million metric tons, citing expectations that the “new government will reduce export restrictions.”

A 48-hour strike initiated Wednesday by cargo train drivers is interrupting produce shipments, disrupting shipments of grains to the port where 80 percent are shipped from, Jaime Valencia, manager of Nuevo Central Argentino cargo railroad, said by telephone from Rosario.

"The union threatens to hold a 72-hour stoppage next week if demands for improved benefits aren’t met," he said. "We transport 50,000 metric tons of grains/oilseeds per day that won’t arrive if the strike continues."

Open all references in tabs: [1 - 5]